Manual review flow

When requesting the anti-fraud analysis, it is possible for the institution to respond that the transaction will be evaluated manually. In this scenario, e-SiTef leaves the transaction in the PPC (Pending Confirmation Payment) state and awaits the completion of the manual evaluation.

The institution must send a notice indicating the completion of the manual evaluation at a given URL, which must be registered on the institution's platform. The merchant must contact the institution and request the registration of the following URL for this notice:

- Homologation Environment:

https://esitef-homologacao.softwareexpress.com.br/e-sitef/processarPost.se?loja=<MerchantID> - Production Environment:

https://esitef-ec.softwareexpress.com.br/e-sitef/processarPost.se?loja=<MerchantID><MerchantID>being the identification of the merchant in e-SiTef. If in doubt, contact our support to obtain this identification.

When e-SiTef receives this notice, some validations will be performed before completing the transaction to a final state. The merchant will receive a notice indicating the final status of this same transaction.

Configure expiration for manual review

Consider the following scenario, the institution respond that it will perform the manual review, but the analysis is never completed. For this situation, e-SiTef requests a configuration by the Store, so that after waiting for the risk analysis to be answered, a decision is made and the transaction is not pending.

The configuration of the parameters should be done on Merchant’s Portal following the steps below:

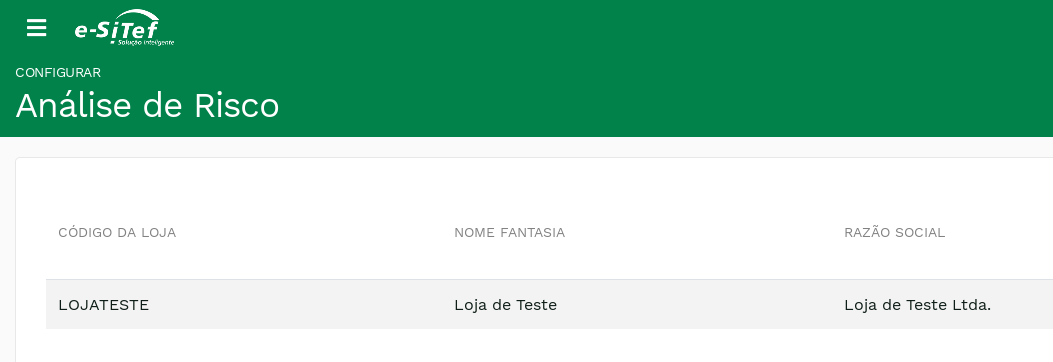

The next figure shows a list of merchants that is presented whenever there are more than one merchant, grouped by user.

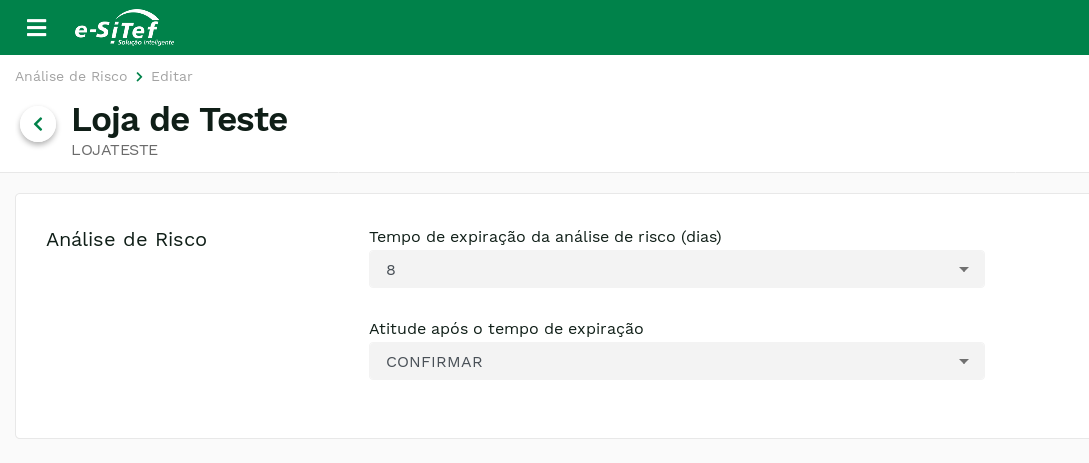

The next figure shows the two fields that need to be configured:

- Tempo de expiração da análise de risco (dias): Response waiting time limit from risk analysis – in days – of which e-SiTef execute an action defined by merchant.

- Atitude após o tempo de expiração: After

Tempo máximo(Maximum Time) is configured, the decision of which action will be executed must be selected in this field - Can be CONFIRM or CANCEL the transaction.

Once the Enviar button is pressed, a message Configurado com sucesso! will be displayed as a confirmation of this modification.

ATTENTION: This configuration must be changed only by merchant who will assume all responsibilities of selected configuration. The e-SiTef only executes the action chosen by the merchant, according the configuration.