Banrisul Vero

The merchant can configure the e-SiTef transactions routing by several payment providers. One of them is Banri Compras, a Banrisul bank e-commerce platform, developed by Banrisul Vero acquirer.

Supported e-SiTef interfaces

The following interfaces are available for integrations with Banrisul Vero:

- HTML Payment

Required Credentials

To start using e-SiTef to make transactions routed by Banrisul Vero, the merchant must have the Network Code, Establishment code and the access password to integrate with Banrisul Vero. For this, the merchant must request their access credentials via e-mail: srac@banrisul.com.br.

The merchant must forward the credentials to the Software Express production/homologation team. These credentials can be registered at the e-SiTef's Merchant's Portal on the "Configurar Autorizadoras" ("Configure Authorizers") menu.

The merchant must register the Access Password to Banri Compras Portal on e-SiTef's Merchant's Portal. This data is important so that e-SiTef can inform the updated transaction status on Banri Compras to the merchant.

| Field | Description |

|---|---|

codigoEstabelecimento | Banrisul Vero establishment code. |

codigoRede | Banrisul Vero network code. |

senha | Banri Compras' Portal access password. |

Request parameters

Banrisul Vero allows three payment types: spot sale, in installments and postdated.

All payment types above are only made via bank transfer.

If the buyer chooses "in installments" or "postdated" payment type, some additional parameters (additional_data.extra_param.params) must be sent in the HTML request as in the examples below.

Learn more about the HTML interface.

Spot sale

No additional data is required if spot sale is chosen. The authorizer id (authorizer_id field) is 411.

Request example

{

"merchant_id":"BANRICOMPRAS",

"order_id":"09024709605",

"authorizer_id":"411",

"amount":"1000"

}

In installments

| Field | Description | Format |

|---|---|---|

bank_installments | Total number of installments. For Banrisul Vero, this field will be used instead of the installments field. | 2 N |

installment | Informs which installments will be paid. Must be informed in NN format. Example: 0102 (installments one and two will be paid). | 2 N for each installment |

deadline_option | Informs if the installments payment deadline will be sent in days or with a specific date. Allowed values: D – Defined by a date.P – Defined by a period in days. | 1 A |

deadline_date | If the option D in the field deadline_option was chosen, the suggested date for the payment of the installments must be informed.The date of each installment must be informed in the YYYYMMDD format. Example: 20181023 (2018-10-23).If more than one installment is informed, concatenate the dates according the installments order. Example: 2018102320181124 (for the first installment the date is 2018-10-23 and, for the second, 2018-11-24). | 8 N for each installment |

deadline_period | If the option P in the field deadline_option was chosen, the suggested period in days of each installment must be informed.The deadline of each installment must be informed in the NNN format. Example: 030 (30 days period for the payment of the installment).If more than one installment is informed, concatenate the periods according the installments order. Example: 030060 (for the first installment the period is 30 days and, for the second, 60 days). | 3 N for each installment |

installments_amount | Informs the amount of each installment that will be paid. The amounts must be informed in the 15N format. Example: 000000000005000 (R$ 50).If more than one installment is informed, concatenate the amounts according the installments order. Example: 000000000005000000000000006000 (for the first installment the amount is R$ 50 and, for the second, R$ 60). | 15 N for each installment |

Request example

{

"merchant_id":"BANRICOMPRAS",

"order_id":"09035003921",

"authorizer_id":"412",

"amount":"1000",

"additional_data":{

"extra_param":{

"params":[

{

"key":"bank_installments",

"value":"02"

},

{

"key":"deadline_option",

"value":"P"

},

{

"key":"installment",

"value":"0102"

},

{

"key":"deadline_date",

"value":""

},

{

"key":"deadline_period",

"value":"000030"

},

{

"key":"installments_amount",

"value":"000000000000500000000000000500"

}

]

}

}

}

Postdated

| Field | Description | Format |

|---|---|---|

bank_installments | 01 obligatorily. | 2 N |

installment | 01 obligatorily. | 2 N |

deadline_option | Informs if the installments payment deadline will be sent in days or with a specific date. Allowed values: D – Defined by a date.P – Defined by a period in days. | 1 A |

deadline_date | If the option D in the field deadline_option was chosen, the suggested date for the payment of the installments must be informed.The date of each installment must be informed in the YYYYMMDD format. Example: 20181023 (2018-10-23).ATTENTION: If the option P is chosen for the deadline_option field, the value 00000000 must be sent in the field. | 8 N |

deadline_period | If the option P in the field deadline_option was chosen, the suggested period in days of each installment must be informed.The deadline of each installment must be informed in the NNN format. Example: 030 (30 days period for the payment of the installment). | 3 N |

installments_amount | Informs the amount of each installment that will be paid. The amounts must be informed in the 15N format. Example: 000000000005000 (R$ 50). | 15 N |

Request example

{

"merchant_id":"BANRICOMPRAS",

"order_id":"09024709605",

"authorizer_id":"413",

"amount":"5000",

"additional_data":{

"extra_param":{

"params":[

{

"key":"bank_installments",

"value":"01"

},

{

"key":"deadline_option",

"value":"P"

},

{

"key":"installment",

"value":"01"

},

{

"key":"deadline_date",

"value":"00000000"

},

{

"key":"deadline_period",

"value":"030"

},

{

"key":"installments_amount",

"value":"000000000005000"

}

]

}

}

}

HTML Payment Flow

After beginning a Banrisul Vero transaction, the following flow will be started:

Learn more about the HTML interface.

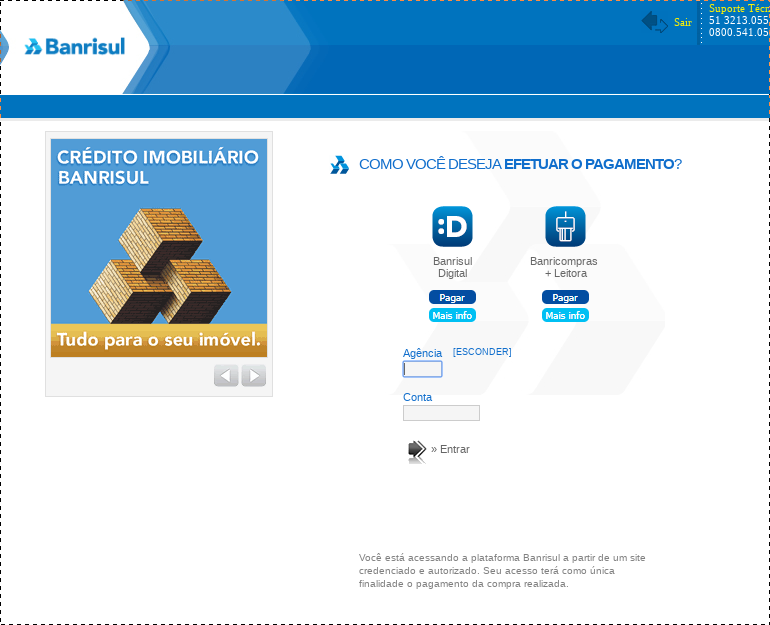

After clicking the "ACESSAR BANCO" button, the buyer will be redirected to the Banri Compras environment:

After finalizing the payment process on the Banri Compras environment, the buyer will be redirected to the success or failure pages (which are configured on the Banri Compras Portal). For further details about the URL's configuration, see the next chapter.

Redirect URL's configuration

To register the redirect URL's, access the Banri Compras' Portal:

http://ww4.banrisul.com.br/banricompras/LINK/logon/Index.asp?info=true

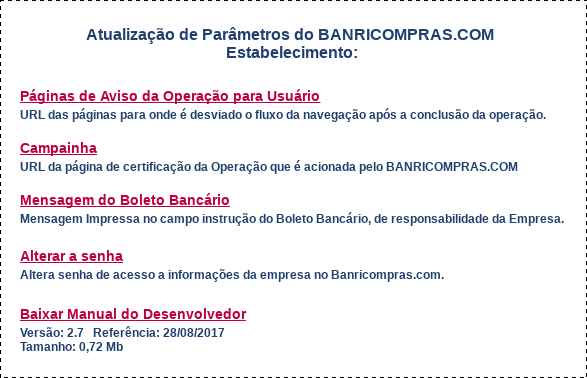

After entering your credentials, the following screen will be displayed:

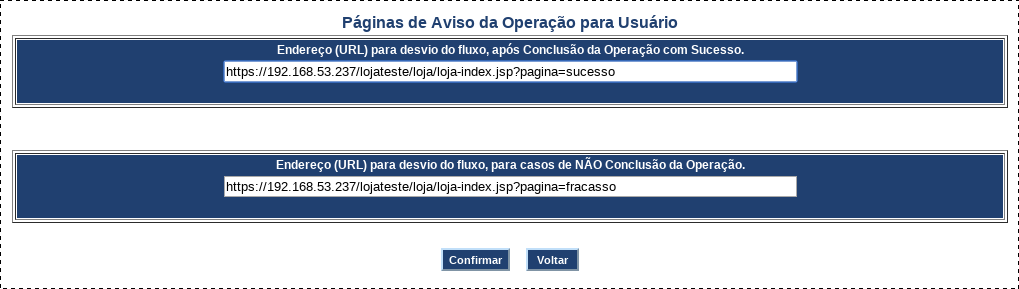

Click on "Paginas de Aviso da Operacao para Usuario" and configure the URL's that the customer will be redirected at the end of the payment on the Banri Compras' environment:

Time configuration on e-SiTef

The e-SiTef is configured with the default time values below, all related to Banrisul Vero transactions:

| Description | Default value |

|---|---|

| Timeout value for the e-SiTef calls to Banrisul Vero. | 60 seconds |

| Maximum days that e-SiTef queries Banrisul Vero about pending transactions. | 15 days |

| Time interval between e-SiTef queries to Banrisul Vero about pending transactions. | 60 seconds |

| Maximum queries Banrisul Vero system about pending transactions. | 10 queries |

Note: The values above are just initial reference values. Please contact the e-SiTef support team to check the exact environment values.