Initializing a payment transaction

Transaction creation process

The transaction creation process must follow these steps:

- The transaction is created according to the parameters sent in the

requestkey and represented by a JSON object via POST in the request; - The merchant receives a success or error message, formatted as XML or JSON, according to the

response_typeparameter in the URL sent when starting a transaction.

URL to start a transaction via HTTPS POST:

| Homologation environment: |

|---|

| https://esitef-homologacao.softwareexpress.com.br/e-sitef-hml/init/[response_type].se |

| Production environment: |

| https://esitef-ec.softwareexpress.com.br/e-sitef/init/[response_type].se |

Attention: The IP should never be used instead of the domain esitef-ec.softwareexpress.com.br (or esitef-homologacao.softwareexpress.com.br for the homologation environment). IP can change at any time and without notice, so it is important to always use the domain to access e-SiTef.

POST parameters:

- Key:

request; - Value: JSON object;

- [response_type]:

jsonorxml;

JSON request example (JavaScriptObjectNotation):

URL: https://esitef-homologacao.softwareexpress.com.br/e-sitef-hml/init/json.se

Basic JSON request example:

{

"merchant_id": "codigoDaLoja",

"amount": "1800"

}

JSON object request with some additional parameters:

{

"merchant_id": "codigoDaLoja",

"order_id": "123456",

"redirect": "A",

"installments": "3",

"installment_type": "4",

"authorizer_id": "1",

"amount": "1800",

"transaction_type":"payment",

"back_url": {

"url_success": "",

"url_failure": "",

"url_cancel": ""

},

"additional_data": {

"currency": "BRL",

"method": "",

"postpone_confirmation": "false",

"payer": {

"identification_number": "22222222222",

"store_identification": "22222222222"

}

}

}

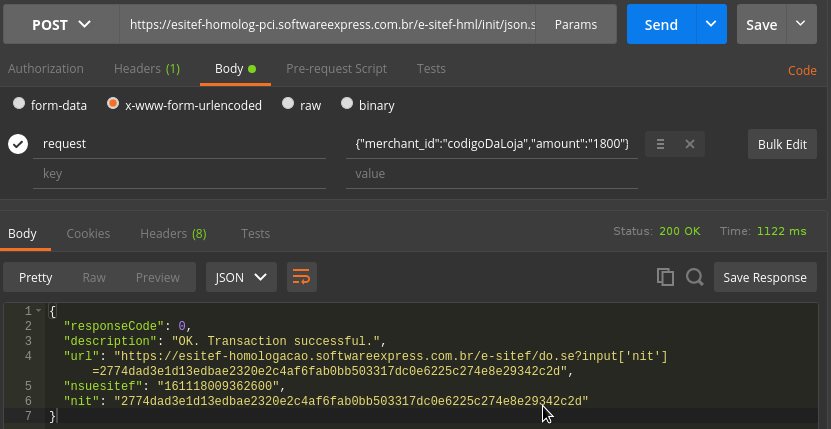

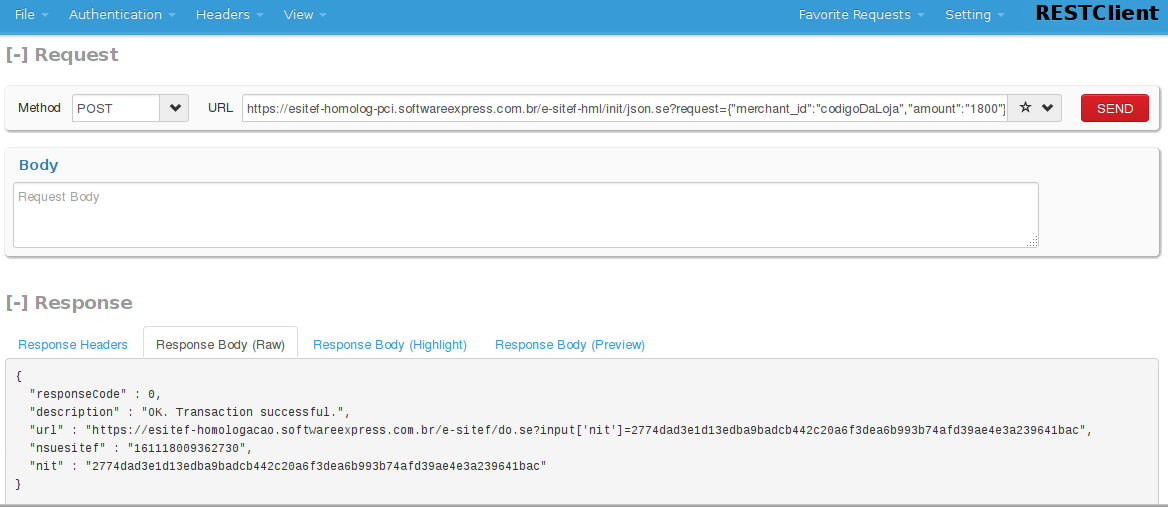

Test tools

For initial testing in this interface, if necessary, some tools can be used in order to better understand REST communication:

- Application for Windows/Linux/Mac:

- Firefox extension:

Sample screens of these tools:

Request parameters

The JSON additional_data object has fields that change according to the authorizer (authorizer_id) for the payment. For more details on the additional_data field, please refer to specific documentation for each authorizer supported by the HTML 2.0 Payment Interface.

{

"amount": "120000",

"authenticate": "false",

"authorizer_id": "1",

"installments": "1",

"installment_type": "4",

"merchant_id": "LOJATESTE",

"merchant_usn": "999888",

"order_id": "order123",

"recharge_included": "false",

"redirect": "M",

"soft_descriptor": "softDescriptor",

"store_card": "false",

"style": "N",

"transaction_type": "payment",

"payment_link":"false",

"additional_data": { },

"back_url": { },

"iata": { },

"recharge": { }

}

| Parameter | Description | Format | Mandatory |

|---|---|---|---|

amount | Total amount to be paid by the customer. Format: Must be sent in cents. e.g.: 1000 (10 dollars). | < 12 N | YES |

authenticate | Parameter informing the need of transaction authentication. Allowed values: 0, 1, 2, 3 and 4.Default value – 0 | < 1 A | NO |

authorizer_id | Authorizer code (on e-SiTef) | < 10 A | NO |

installments | Number of installments of the payment. The following authorizers do not allow prefixing this value, therefore in this case the parameter must not be sent:

1. | < 2 N | NO |

installment_type | Financing type chosen by the customer. Allowed values: 3 – installments with interest4 – installments without interest Default value = 4. | = 1 N | NO |

merchant_id | Merchant code on e-SiTef. | < 15 A | YES |

merchant_usn | Identification code of the transaction generated by the merchant. | < 12 A | NO |

order_id | Order code (generated by the merchant) | < 40 AN | NO |

recharge_included | Informs if a recharge will be performed. Allowed values: true – if a recharge will be performed.false – if a recharge will not be performed.Default value – false | = 5 A | NO |

redirect | Type of the redirection that will be performed after the end of the transaction flow on e-SiTef. Allowed values: A – (Automatic) automatic redirection: the final screen of the payment won't be shown (including the receipt) and the customer is automatically redirected to one of the url's of the parameter back_url. In addition, the nit parameter is sent along with a HTTP GET request.M – (Manual) manual redirection: Shows the final screen of the payment including the receipt and shows a link to the customer to click and be redirected to the merchant's web site. In addition, the nit parameter is sent with a HTTP POST request.Default value – M (Manual) | = 1 A | NO |

soft_descriptor | Name of the establishment that will be presented in the credit card invoice. Learn more | < 30 A | NO |

store_card | Indicates if the card used for the payment will be stored. Allowed values: true – Indicates that the card used for the payment will be stored.false – Indicates that the card used for the payment will not be stored.Default value – false (store will not be performed)If the merchant sends this field with value true, the additional_data.payer.store_identification field becomes mandatory. | < 5 A | NO |

style | Informs the redirection style to e-SiTef. Allowed values: N – Redirection at the same frame.P – A pop-up will be opened.Default value – NThe merchant must inform the redirection style in order to e-SiTef handle properly the windows at the final of the payment transaction. | = 1 A | NO |

transaction_type | Transaction type that will be performed. Allowed values: payment – In case of Paymentpreauthorization – In case of Pre-AuthorizationDefault value – payment | < 32 A | NO |

payment_link | This field must receive the value true to activate the payment link functionality. | < 5 A | NO |

additional_data | ADDITIONALDATA object | NO | |

back_url | BACKURL object | NO | |

iata | IATA object | NO | |

recharge | RECHARGE object. Contains information related to a recharge transaction. | NO |

BACKURL (back_url)

{

"url_cancel": "https://cancel.com",

"url_failure": "https://failure.com",

"url_success": "https://success.com"

}

| Parameter | Description | Format | Mandatory |

|---|---|---|---|

url_success | Redirection URL of the customer in case of success. Must have only the relative path. | < 200 A | NO |

url_failure | Redirection URL of the customer in case of failure. Must have only the relative path. | < 200 A | NO |

url_cancel | Redirection URL of the customer in case of cancel. Must have only the relative path. | < 200 A | NO |

IATA (iata)

{

"departure_tax": "1000",

"first_installment": "20000"

}

| Parameter | Description | Format | Mandatory |

|---|---|---|---|

departure_tax | Departure tax amount. | < 200 A | NO |

first_installment | First installment value. | < 200 A | NO |

ADDITIONALDATA (additional_data)

{

"currency": "BRL",

"method": "",

"postpone_confirmation": "false",

"financing_plan": "",

"payer": { }

}

| Parameter | Description | Format | Mandatory |

|---|---|---|---|

currency | Default currency used for all the items in the purchase. Currency code according to the ISO 4217 standards. Some allowed values: BRL – RealVEF – Venezuelan bolívar fuerteUSD – American DollarGBP – PoundAmong others. If this parameter is not sent, e-SiTef will use the merchant configuration, and if the merchant is not configured, the value BRL will be used as the default value. | = 3 A | NO |

method | Used to perform differentiated transactions. Allowed values: split – Performs a SPLIT transaction. | < 1024 AN | NO |

postpone_confirmation | Allows the merchant to keep the transaction as Pending Confirmation, and later, confirm or cancel it. | < 5 A | NO |

financing_plan | Financing Plan code. Required only in payments in installments and with interests routed by Via Certa. It must be sent only if authorizer_id (Via Certa routed authorizer), installments (>1) and installments_type (3 = with interest) fields were also sent in this step. | < 4 AN | NO |

max_installments | Maximum installments without interest that will be presented to the payer at the checkout. If informed, it will overwrite the value configured in the e-SiTef store. If the acquirer also returns a maximum value of installments, the value used will always be the smallest. | < 3 N | NÃO |

submerchant_split | SUBMERCHANT_SPLIT object. It consists of an array for split payments, unique to BIN and Sipag routing, both via SiTef. It allows the division of parts of the total amount of the payment among other merchants. Exclusive functionality for payments ( transaction_type:payment).The maximum number of items allowed in this array is 5 items. This should not be used together with the method:split field mentioned above, as it is a different functionality. | NO | |

payer | PAYER object | NO | |

mcc | The MCC (Merchant Category Code) is a code that classifies the business by the type of goods or services it provides. This field is used by the sub-merchant funding functionality via SiTef. | 4 N | NO |

subacquirer_merchant_id | It is the merchant identification for the subacquirer. This field is used by the sub-merchant funding functionality via SiTef. | 22 N | NO |

multiple_payment_methods | Indicates if the merchant will allow the customer to pay using two payment methods. Do not send this field as true when prefixing an authorizer. | < 5 T/F | NO |

SUBMERCHANT_SPLIT[] (submerchant_split)

[

{

"submerchant_code":"empresa01",

"submerchant_amount":"120"

},

{

"submerchant_code":"empresa02",

"submerchant_amount":"420"

},

{

"submerchant_code":"empresa03",

"submerchant_amount":"300"

},

{

"submerchant_code":"empresa04",

"submerchant_amount":"400"

},

{

"submerchant_code":"empresa05",

"submerchant_amount":"250"

}

]

| Parameter | Description | Format | Mandatory |

|---|---|---|---|

submerchant_code | BIN/Sipag merchant code | < 15 AN | NO |

submerchant_amount | Transaction amount related to the merchant. | < 12 N | NO |

PAYER (payer)

{

"store_identification": "card_1",

"identification_number": "123123123"

}

| Parameter | Description | Format | Mandatory |

|---|---|---|---|

store_identification | Identification of the owner of the card to be stored. This identification must be unique for each of the merchant's customers. Attention: assuring uniqueness is a responsibility of the merchant. E-SiTef does not perform any validation. | < 20 | NO |

identification_number | Payer's identification number. | < 1024 | NO |

Note 1: The parameters specification of the

additional_dataobject may vary according to the authorizer. See the specific documentation for more details.

Note 2: In the case of pre-fixed installments that declare the

installmentsandinstallment_typefields without theauthorizer_iddefinition, the following rules will apply to the available authorizers options that e-SiTef will present to the customer:

- The wallets (Visa Checkout, Masterpass, GooglePay), PayPal, PagSeguro and MercadoPago options will be omitted. The reason is that installments options can be defined by the consumer inside the payment method's environment.

- If the payment has more than one installment (

installments>1), only credit options will be shown and, from these options, only those that match the installments configuration in merchant's registration in e-SiTef.Advice: Adjust this e-SiTef configurations as agreed with acquirers. For more details, please contact e-SiTef support team, or access the Merchant's Portal.

Attention: In case of iCards via Sitef routed payments, the fields

authorizer_id,installments, andinstallment_typemust be pre-fixed in transaction creation step. So it is not possible to the user choose or change this information during the browsing.

Response parameters

The response of the transaction creation operation (JSON format):

{

"responseCode": 0,

"description": "OK. Transaction successful.",

"url": "https:// esitef-homologacao.softwareexpress.com.br/e-sitef/do.se?input['nit']= 1234567890abcdefghijklmnopqrstuvwxyz1234567890abcdefghijklmnopqr",

"nsuesitef": "123456789012345",

"nit": "1234567890abcdefghijklmnopqrstuvwxyz1234567890abcdefghijklmnopqr"

}

The returned fields are described in table below:

| Parameter | Description | Format |

|---|---|---|

responseCode | e-SiTef response code. Any code different from 0(zero) means failure. Learn more. | < 5 N |

description | Response description. | < 1024 A |

url | Redirection URL to begin the payment. | < 256 A |

nit | Transaction identifier on e-SiTef. | = 64 A |

nsuesitef | USN (Unique Sequential Number) of the transaction on e-SiTef. | = 15 A |